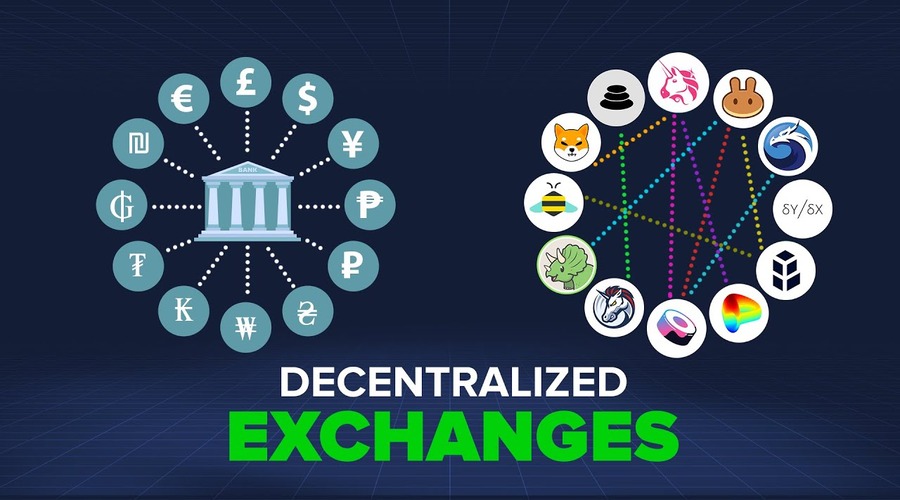

Decentralized exchanges have gained significant traction in the world of cryptocurrencies, providing users with a trustless and permissionless way to trade digital assets. However, liquidity has been a persistent challenge for these platforms. In this article, we will explore the strategies and mechanisms employed to address liquidity concerns in decentralized exchanges.

The Significance of Liquidity in Decentralized Exchanges

Liquidity refers to the ease with which an asset can be bought or sold without causing a significant impact on its price. In the context of decentralized exchanges, liquidity is essential for smooth trading operations, fair price discovery, and minimizing slippage. High liquidity attracts more traders and enhances the overall user experience.

Challenges Faced by Decentralized Exchanges

Decentralized exchanges face several challenges when it comes to liquidity. These challenges include limited market depth, fragmented liquidity across different trading pairs, and vulnerability to market manipulation. Overcoming these hurdles requires innovative solutions and strategic approaches.

- Limited Market Depth: Decentralized exchanges often struggle with limited market depth, especially when compared to centralized exchanges. This means that there may be insufficient liquidity for certain trading pairs, making it challenging for traders to execute large orders without significantly impacting the price.

- Fragmented Liquidity: Liquidity in decentralized exchanges is often fragmented across different trading pairs and platforms. This fragmentation makes it difficult for traders to access deep and interconnected markets. It also hinders price discovery and creates arbitrage opportunities.

- Vulnerability to Market Manipulation: Decentralized exchanges, especially those with lower trading volumes, are susceptible to market manipulation. Without robust monitoring and surveillance mechanisms, it becomes challenging to detect and prevent activities such as wash trading, spoofing, and front-running.

- Slower Trade Execution: Compared to centralized exchanges that can execute trades almost instantaneously, decentralized exchanges may experience slower trade execution due to network congestion and the time required for block confirmation. This can be a deterrent for traders who prioritize speed and efficiency.

- User Experience: The user experience in decentralized exchanges is often perceived as less intuitive and user-friendly compared to centralized counterparts. Issues such as complex wallet management, interaction with smart contracts, and the need for transaction approval can create friction for users, particularly those new to blockchain technology.

- Regulatory Uncertainty: Decentralized exchanges operate in a regulatory gray area in many jurisdictions. Uncertainty around compliance requirements and potential regulatory actions can discourage both users and liquidity providers from engaging with decentralized exchanges.

- Lack of Fiat Integration: Many decentralized exchanges primarily facilitate trading between cryptocurrencies, lacking direct integration with traditional fiat currencies. This limits accessibility for users who prefer to trade using fiat currencies and adds complexity when converting between fiat and cryptocurrencies.

- Price Volatility: Cryptocurrency price volatility presents a challenge for decentralized exchanges. Sudden price swings can result in increased slippage and make it difficult for market makers to maintain stable and competitive bid-ask spreads.

- Scalability and Network Congestion: Some decentralized exchanges struggle with scalability issues and network congestion, particularly during periods of high trading activity or when the underlying blockchain network experiences congestion. This can lead to higher transaction fees and delays in trade settlement.

- Lack of Interoperability: Interoperability among decentralized exchanges is still in its early stages. The lack of standardized protocols and seamless integration between different platforms limits liquidity sharing and hinders the growth of decentralized exchange ecosystems.

Addressing these challenges is essential for the continued development and widespread adoption of decentralized exchanges. By implementing innovative solutions and leveraging emerging technologies, the decentralized exchange ecosystem can overcome these obstacles and provide a more robust and user-friendly trading experience.

Market Making: A Key Strategy for Liquidity Provision

Market making is a fundamental strategy employed by liquidity providers to ensure continuous liquidity in decentralized exchanges. Market makers place buy and sell orders to narrow the bid-ask spread, allowing traders to execute trades at fair prices. By actively participating in the market, market makers enhance liquidity and contribute to price stability.

Automated Market Makers (AMMs): Empowering Liquidity Provision

Automated Market Makers (AMMs) have emerged as a revolutionary mechanism for liquidity provision in decentralized exchanges. AMMs utilize smart contracts to create liquidity pools, eliminating the need for traditional order books. They employ algorithms, such as the constant product formula, to automatically determine asset prices based on supply and demand. AMMs have democratized liquidity provision, enabling anyone to become a liquidity provider and earn fees by contributing assets to the liquidity pools.

Liquidity Mining: Incentivizing Liquidity Providers

Liquidity mining, also known as yield farming, is a mechanism used by decentralized exchanges to incentivize liquidity providers. By offering additional rewards in the form of native tokens, DEXs motivate users to contribute assets to the liquidity pools. Liquidity mining has proven to be an effective strategy in attracting liquidity and bootstrapping decentralized ecosystems.

Decentralized Exchanges and Liquidity Aggregation

Liquidity aggregation platforms have emerged to address the issue of fragmented liquidity across different decentralized exchanges. These platforms pool liquidity from various sources, providing traders with access to deeper markets and better trading opportunities. Liquidity aggregation enhances the overall liquidity landscape of decentralized exchanges.

The Role of Stablecoins in Liquidity Enhancement

Stablecoins, such as Tether (USDT) and Dai (DAI), have become integral to liquidity provision in decentralized exchanges. By pegging their value to a stable asset, stablecoins mitigate the volatility associated with cryptocurrencies. They serve as a reliable medium of exchange and store of value, attracting traders and enhancing liquidity in DEXs.

Impermanent Loss: A Concern for Liquidity Providers

Liquidity providers in decentralized exchanges face the risk of impermanent loss. Impermanent loss occurs when the value of assets held in a liquidity pool diverges from the value of the same assets held outside the pool due to price fluctuations. Understanding and mitigating impermanent loss is crucial for liquidity providers to optimize their returns.

Factors Influencing Liquidity in Decentralized Exchanges

Several factors influence the liquidity of decentralized exchanges. These factors include trading volume, token utility, network effects, user experience, and integration with other DeFi protocols. By considering these factors, DEXs can design strategies to attract liquidity and create vibrant trading ecosystems.

Best Practices for Liquidity Management

To effectively manage liquidity, decentralized exchanges should implement best practices such as conducting thorough market analysis, establishing partnerships with liquidity providers, monitoring market conditions, optimizing fee structures, and continuously innovating to stay ahead of the competition. By adopting these practices, DEXs can enhance liquidity and maintain a competitive edge.

Security Considerations in Liquidity Provision

Liquidity provision in decentralized exchanges carries inherent security risks. DEXs must implement robust security measures to safeguard user funds and prevent potential exploits. Smart contract audits, multi-signature wallets, and insurance funds are some of the security measures that can instill confidence in liquidity providers and traders.

Regulatory Challenges and Compliance

Decentralized exchanges operate in a rapidly evolving regulatory landscape. Compliance with relevant regulations is essential to ensure the long-term sustainability of DEXs. By collaborating with regulatory authorities and adopting compliance frameworks, DEXs can establish trust and legitimacy in the eyes of institutional investors and regulators.

Future Trends in Liquidity Provision

The field of liquidity provision in decentralized exchanges is constantly evolving. Future trends may include the integration of layer 2 scaling solutions, the rise of cross-chain liquidity, increased adoption of decentralized derivatives, and the emergence of decentralized lending and borrowing platforms. Staying updated with these trends will be crucial for liquidity providers and traders alike.

Conclusion

Liquidity is a critical component of decentralized exchanges, and ensuring its availability is paramount for the success of these platforms. Through market making, automated market makers, liquidity mining, and liquidity aggregation, decentralized exchanges are tackling liquidity challenges head-on. By considering best practices, security measures, and future trends, DEXs can create vibrant and sustainable trading ecosystems.

FAQs (Frequently Asked Questions)

Q1: What is liquidity in decentralized exchanges?

A1: Liquidity in decentralized exchanges refers to the availability of assets that can be easily bought or sold without causing significant price slippage. It represents the depth and efficiency of the market, allowing traders to execute transactions quickly and at fair prices. High liquidity ensures smooth trading operations and enhances the overall user experience in decentralized exchanges.

Q2: Why is liquidity important for decentralized exchanges?

A2: Liquidity is crucial for decentralized exchanges due to several reasons. First, it enables efficient price discovery by minimizing the impact of large buy or sell orders on asset prices. This fosters fair and transparent trading environments. Second, liquidity attracts traders and investors, contributing to increased trading volume and market activity. Additionally, high liquidity reduces slippage, which occurs when the execution price differs from the expected price due to a lack of available liquidity. Overall, liquidity enhances market stability, user participation, and the overall functionality of decentralized exchanges.

Q3: How do market makers contribute to liquidity provision?

A3: Market makers play a vital role in providing liquidity to decentralized exchanges. They actively participate in the market by placing both buy and sell orders for specific assets. By continuously offering to buy and sell at competitive prices, market makers narrow the bid-ask spread—the difference between the highest price a buyer is willing to pay and the lowest price a seller is willing to accept. This narrower spread makes it easier for traders to execute transactions at fair prices. Market makers assume the risk of holding inventory to ensure liquidity, and they profit from the spread or fees associated with their market-making activities.

Q4: What are automated market makers (AMMs)?

A4: Automated market makers (AMMs) are innovative mechanisms used in decentralized exchanges to facilitate liquidity provision without relying on traditional order books. AMMs utilize smart contracts and predefined mathematical formulas to determine asset prices based on the ratio of assets held in a liquidity pool. The most common AMM algorithm is the constant product formula, which ensures that the product of the quantities of two assets in a pool remains constant. Users can contribute assets to AMM liquidity pools and earn fees for their contributions. AMMs democratize liquidity provision and enable decentralized trading by eliminating the need for centralized intermediaries.

Q5: How does liquidity mining incentivize liquidity providers?

A5: Liquidity mining, also known as yield farming, is a mechanism used by decentralized exchanges to incentivize liquidity providers. Liquidity providers contribute assets to liquidity pools, and in return, they receive additional rewards in the form of native tokens from the exchange. These rewards can be generated by a variety of sources, such as transaction fees, platform governance tokens, or other revenue streams. Liquidity mining incentivizes users to lock their assets in the liquidity pools, ensuring continuous liquidity in the decentralized exchange. By offering additional incentives, DEXs attract liquidity providers and stimulate the growth of their platforms.